Present Value Calculator

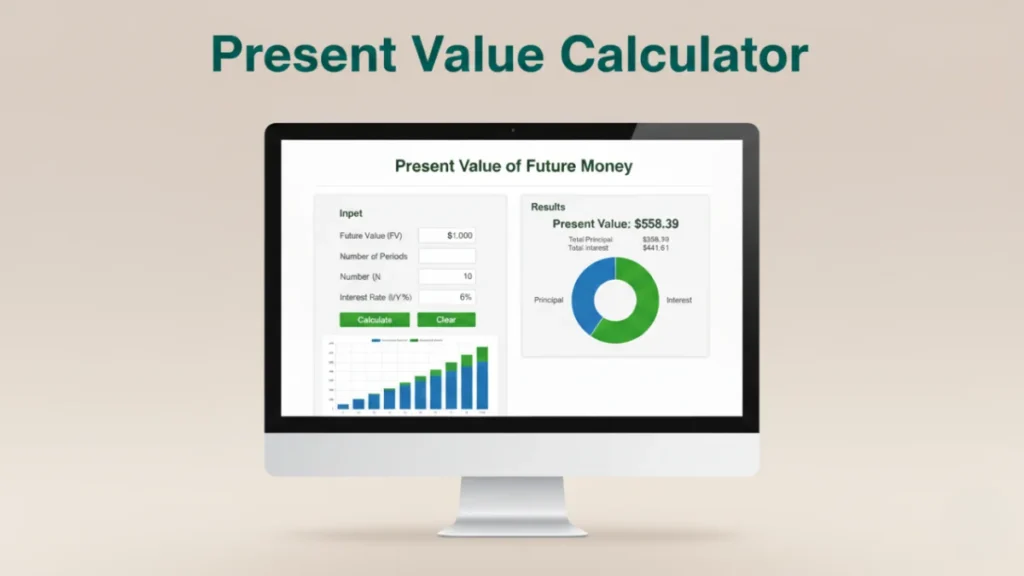

Present Value of Future Money

Results

Present Value of Periodical Deposits

Results

| Period | Deposits (cumulative) | Interest (cumulative) | End Balance |

|---|

Calculate the PV of a lump sum or an annuity. Our tool includes charts, a period-by-period schedule, and handles both beginning and end of period payments.

Related

Present Value Calculator: What Is Your Future Money Worth Today?

Is winning $1 million in twenty years the same as having $1 million in your bank account right now? The answer is a resounding no. Money, like everything else, has a time value. A dollar today is more powerful than a dollar tomorrow because of its potential to earn interest and its purchasing power against inflation.

This is the core concept behind Present Value (PV). It’s a financial calculation that tells you what a future amount of money is worth in today’s dollars. It helps you cut through the hype of future promises and make apples-to-apples comparisons for investments, savings goals, and financial planning.

Our comprehensive Present Value Calculator, with its two distinct modes, is designed to give you that clarity.

(Here you would embed the Present Value Calculator widget)

What is Present Value (PV)?

Present Value (PV) is the current worth of a future sum of money or stream of cash flows, given a specified rate of return. The process of finding the present value is called discounting. It’s the opposite of compounding, which calculates the future value of an investment.

Think of it like this: If you want to have $10,000 in five years and you can earn a 5% annual return, you don’t need to invest $10,000 today. You can invest a smaller amount—the present value—and let it grow to $10,000. The PV calculation tells you exactly how much that smaller amount is.

A Tale of Two Calculators: Lump Sum vs. Periodical Deposits

Our tool is split into two sections to handle the two most common financial scenarios.

1. Present Value of a Future Money (Lump Sum)

This calculator is used when you want to find the present value of a single future payment.

Use it for questions like:

- “I’m inheriting $50,000 in 10 years. What is that worth today?”

- “To have $1,000,000 for retirement in 30 years, how much do I need to have invested today, assuming no further contributions?”

- “A bond will pay me back $10,000 at maturity. What is a fair price to pay for it now?”

2. Present Value of Periodical Deposits (Annuity)

This calculator is for determining the present value of a series of equal, regular payments (an annuity).

Use it for questions like:

- “I want to receive $5,000 every year for 20 years during retirement. How much money do I need in my retirement account when I start?”

- “I won a lottery that pays $25,000 a year for 10 years. What is the lump-sum cash value of that prize today?”

- “What is the current value of a business that is expected to generate $100,000 in profit each year for the next 5 years?”

How to Use Our Present Value Calculator

Follow these simple steps to find the present value for your scenario.

- Select a Calculator: Choose the section that matches your goal (Future Money or Periodical Deposits).

- Choose Your Currency: Use the tab selector to pick your currency (

$,€,£,₹,¥). This will format all results. - Enter Your Values:

- Future Value (FV) or Periodic Deposit (PMT): Enter the future lump sum or the amount of each regular payment.

- Number of Periods (N): The total number of years (or periods) until the money is received.

- Interest Rate (I/Y): This is the discount rate. It’s the annual rate of return you could earn on an investment today (e.g., your expected stock market return or a savings account interest rate).

- Payment Timing (for Periodical Deposits): Choose if payments are made at the

beginningorendof each period. This slightly changes the calculation.

- Click “Calculate”: The tool will instantly provide a full breakdown.

Understanding Your Results

The calculator gives you more than just a single number; it provides a complete financial picture.

- Present Value (PV): The main result. This is the value of the future cash flow(s) in today’s dollars.

- Total Interest: This shows the total amount of money earned (or discounted) over the entire period. It’s the difference between the total future dollars and the present value.

- Charts & Schedule: The visualizations for the “Periodical Deposits” calculator show the forward-looking growth of those deposits. This helps you understand how the future value is constructed, which is then discounted back to find the present value. The pie chart breaks down the final future amount into the principal you contributed and the interest it earned.

The Math Explained: The Present Value Formulas

For those interested in the mechanics, the calculator uses these standard financial formulas:

1. Present Value of a Lump Sum

PV = FV / (1 + i)^N

PV= Present ValueFV= Future Valuei= Interest (discount) rate per periodN= Number of periods

2. Present Value of an Annuity (Periodical Deposits)

Ordinary Annuity (payments at END of period):PV = PMT * [ (1 - (1 + i)^-N) / i ]

Annuity Due (payments at BEGINNING of period):PV = PMT * [ (1 - (1 + i)^-N) / i ] * (1 + i)

PMT= The amount of each periodic payment

Frequently Asked Questions (FAQ)

What’s the difference between present value and future value?

Present Value (PV) is today’s value of future money, while Future Value (FV) is how much today’s money will grow to in the future with interest or returns.

Here’s a simple example 👇

Suppose you have ₹1,000 today and put it in the bank at 10% interest for 1 year.

After a year, it becomes ₹1,100.

✅ Here,

Present Value (PV) = ₹1,000 (today’s money)

Future Value (FV) = ₹1,100 (money after 1 year)

How accurate is this for real-world scenarios?

It’s based on standard formulas but excludes taxes/fees. Consult a professional for advice.

Does this calculator account for inflation?

No, it calculates the nominal present value. To get a rough estimate of the “real” present value (adjusted for inflation), you can use a real discount rate. Simply subtract the expected inflation rate from your interest rate (e.g., 7% expected return – 3% inflation = 4% real discount rate).

How is Present Value different from Future Value?

They are two sides of the same coin. Future Value (FV) compounds your current money forward to see what it will be worth later. Present Value (PV) discounts future money backward to see what it’s worth now.

- For business valuation: This is often the company’s Weighted Average Cost of Capital (WACC).

- As a risk-free rate: You could use the interest rate on a U.S. Treasury bond.

2. How is Present Value different from Future Value?

They are two sides of the same coin. Future Value (FV) compounds your current money forward to see what it will be worth later. Present Value (PV) discounts future money backward to see what it’s worth now.

3. Does this calculator account for inflation?

No, it calculates the nominal present value. To get a rough estimate of the “real” present value (adjusted for inflation), you can use a real discount rate. Simply subtract the expected inflation rate from your interest rate (e.g., 7% expected return – 3% inflation = 4% real discount rate).

Conclusion: Make Financially Sound Decisions

Understanding present value moves you from being a passive observer to an active architect of your financial life. It allows you to weigh different investment opportunities, understand the true value of retirement plans, and negotiate everything from business deals to lottery payouts with confidence.

Use the calculator above to translate future promises into today’s reality and take the first step toward a clearer financial future.

Similar Calculator