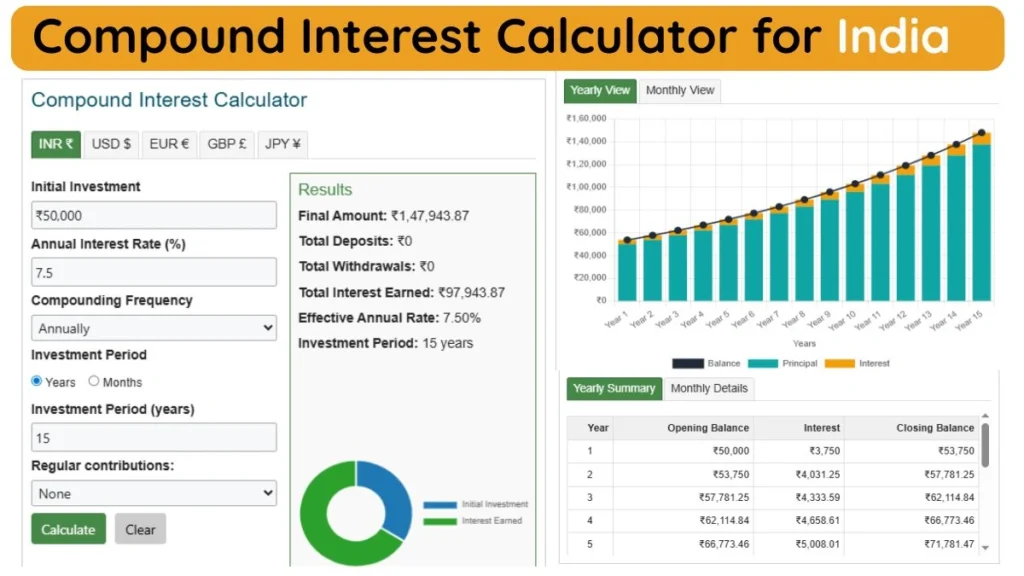

Compound Interest Calculator India

Results

Investment Growth Over Time

Growth Schedule

| Year | Opening Balance | Deposits | Withdrawals | Interest | Closing Balance |

|---|

Related

Compound Interest Calculator India – Calculate Investment Growth Accurately

A Compound Interest Calculator India helps investors understand how their money grows over time by reinvesting earned interest. In India, compound interest plays a major role in long-term wealth creation through instruments like Fixed Deposits (FDs), SIPs, Mutual Funds, PPF, EPF, and NPS.

This calculator is designed for Indian users who want clear, accurate, and visual results in ₹ INR, along with charts, yearly breakdowns, and effective annual returns.

What Is Compound Interest?

Compound interest means interest earned on both the principal and previously earned interest. Over time, this creates a snowball effect, allowing investments to grow faster compared to simple interest.

Simple Interest vs Compound Interest

| Feature | Simple Interest | Compound Interest |

|---|---|---|

| Interest calculation | Only on principal | On principal + interest |

| Growth speed | Linear | Exponential |

| Best for | Short-term loans | Long-term investments |

| Wealth creation | Limited | Powerful |

For long-term Indian investors, compound interest is the backbone of financial growth.

Compound Interest Formula (India)

The standard compound interest formula used by calculators is:

[latex]A = P \left(1 + \frac{r}{n}\right)^{nt}[/latex]

Where:

- A = Final amount

- P = Initial investment (₹)

- r = Annual interest rate (in decimal)

- n = Compounding frequency per year

- t = Investment duration in years

Interest Earned:

[latex]\text{Compound Interest} = A – P[/latex]

This formula is applied automatically inside the calculator, removing manual errors.

How to Use the Compound Interest Calculator

Using the Compound Interest Calculator is simple and helps you calculate investment growth in just a few steps.

Step 1: Enter Initial Investment

In the Initial Investment field, enter the amount you plan to invest.

Example: 50000 (₹50,000)

Step 2: Enter Annual Interest Rate

Enter the annual interest rate (%) offered by the bank or investment scheme.

Example: 7.5

Step 3: Select Compounding Frequency

Choose how often the interest is added to your investment:

- Annually

- Half-Yearly

- Quarterly

- Monthly

Higher compounding frequency results in slightly higher returns.

Step 4: Choose Investment Period

Select the investment duration:

- Years

- Months

Then enter the total time period.

Example: 15 Years

Step 5: Add Regular Contributions (Optional)

If you plan to add money regularly, select the contribution type.

If no additional deposits are planned, keep it as None.

Step 6: Click Calculate

Press the Calculate button to instantly view the results.

The calculator will display:

- Final Amount

- Total Interest Earned

- Effective Annual Rate

- Investment Period

- Interactive Growth Chart

- Year-wise Growth Schedule Table

Step 7: Analyze the Results

- Use the chart to visually understand growth over time

- Check the Growth Schedule Table for yearly interest breakdown

- Compare different rates or durations to plan better

Step 8: Reset Values (Optional)

Click Clear to reset all fields and start a new calculation.

This calculator helps you make smarter investment decisions by clearly showing how compound interest grows your money over time.

Example: Compound Interest Calculation in India

Initial Investment: ₹5,0000

Interest Rate: 7.5% per year

Compounding: Annually

Investment Period: 15 Years

Result:

- Final Amount: ₹1,47,943.87

- Interest Earned: ₹97,943.87

This example matches typical FD-style annual compounding, making it easy for Indian users to relate.

Understanding Compounding Frequency

The frequency of compounding significantly impacts returns.

| Frequency | Compounds Per Year |

|---|---|

| Annually | 1 |

| Half-Yearly | 2 |

| Quarterly | 4 |

| Monthly | 12 |

| Daily | 365 |

Higher compounding frequency leads to slightly higher returns, especially over long durations.

Investment Growth Chart Explained

Your calculator includes interactive bar and line charts that visually show:

- Principal Amount

- Interest Accumulated Each Year

- Total Balance Over Time

Chart Benefits

- Easy comparison between years

- Visual clarity of growth

- Hover-based detailed values

- Better financial planning insight

Visual tools improve understanding far more than plain numbers.

Growth Schedule Table (Year-Wise)

The Growth Schedule displays:

| Year | Opening Balance | Interest | Closing Balance |

|---|---|---|---|

| 1 | ₹50,000.00 | ₹3,750.00 | ₹53,750.00 |

| 2 | ₹53,750.00 | ₹4,031.25 | ₹57,781.25 |

| 3 | ₹57,781.25 | ₹4,333.59 | ₹62,114.84 |

| 4 | ₹62,114.84 | ₹4,658.61 | ₹66,773.46 |

| 5 | ₹66,773.46 | ₹5,008.01 | ₹71,781.47 |

| 6 | ₹71,781.47 | ₹5,383.61 | ₹77,165.08 |

| 7 | ₹77,165.08 | ₹5,787.38 | ₹82,952.46 |

| 8 | ₹82,952.46 | ₹6,221.43 | ₹89,173.89 |

| 9 | ₹89,173.89 | ₹6,688.04 | ₹95,861.93 |

| 10 | ₹95,861.93 | ₹7,189.64 | ₹1,03,051.58 |

| 11 | ₹1,03,051.58 | ₹7,728.87 | ₹1,10,780.45 |

| 12 | ₹1,10,780.45 | ₹8,308.53 | ₹1,19,088.98 |

| 13 | ₹1,19,088.98 | ₹8,931.67 | ₹1,28,020.65 |

| 14 | ₹1,28,020.65 | ₹9,601.55 | ₹1,37,622.20 |

| 15 | ₹1,37,622.20 | ₹10,321.67 | ₹1,47,943.87 |

Final Summary

- Total Investment: ₹50,000

- Total Interest Earned: ₹97,943.87

- Final Amount After 15 Years: ₹1,47,943.87

This example is ideal for explaining long-term compound interest growth in India, especially for FDs, lump-sum mutual funds, and retirement planning.

Why Use a Compound Interest Calculator in India?

Indian financial products rely heavily on compounding.

Common Use Cases

- Fixed Deposit maturity calculation

- SIP and mutual fund growth

- Retirement planning

- Child education planning

- Wealth accumulation goals

Manual calculation can be confusing and time-consuming. A calculator removes complexity instantly.

Benefits of This Calculator for Indian Users

- ₹ INR-based calculations

- Accurate formulas

- No registration required

- Mobile & desktop friendly

- Visual charts and tables

- Supports long-term planning

It works perfectly for students, salaried professionals, business owners, and retirees.

Effective Annual Interest Rate Explained

The Effective Annual Rate (EAR) shows the true yearly return after compounding.

[latex]\text{EAR} = \left(1 + \frac{r}{n}\right)^n – 1[/latex]

This value is especially important when comparing:

- Banks offering different compounding options

- Investment schemes with similar nominal rates

Compound Interest vs SIP Returns

SIP returns are also based on compounding but involve regular monthly investments.

Key difference:

- Compound Interest Calculator → Lump sum focus

- SIP Calculator → Periodic investments

Both tools complement each other for complete financial planning.

Tax Considerations in India

Interest earned may be taxable depending on the investment type:

- FD Interest: Taxable

- Savings Account: Partial exemption

- PPF / EPF: Tax-free (subject to rules)

- Mutual Funds: Capital gains tax applies

Always calculate post-tax returns for realistic planning.

Who Should Use This Calculator?

- First-time investors

- Long-term planners

- Students learning finance

- Bloggers & educators

- Financial advisors

The simplicity combined with depth makes it suitable for all.

Tips to Maximize Compound Interest Returns

- Start investing early

- Increase investment duration

- Choose higher compounding frequency

- Reinvest earnings

- Avoid premature withdrawals

Time is the most powerful factor in compounding.

FAQs

Frequently Asked Questions (FAQs)

A Compound Interest Calculator helps you calculate how your investment grows over time when interest is added to both the principal and previously earned interest.

How do I use the Compound Interest Calculator?

Enter the initial investment amount, annual interest rate, compounding frequency, and investment period, then click Calculate to see the final amount and interest earned.

Is this calculator suitable for Indian investments?

Yes, the calculator is designed for Indian users and shows results in ₹ INR, making it suitable for fixed deposits, mutual funds, PPF, and long-term investments.

Does compounding frequency affect returns?

Yes, higher compounding frequency such as monthly or quarterly results in slightly higher returns compared to annual compounding over the same period.

Can I use this calculator for fixed deposits?

Yes, by selecting the correct interest rate and compounding option offered by the bank, the calculator works accurately for fixed deposits.

Does the calculator show year-wise growth?

Yes, it provides a year-wise growth schedule showing opening balance, interest earned, and closing balance for each year.

Conclusion

A Compound Interest Calculator India is an essential financial tool for anyone serious about long-term wealth creation. By combining accurate formulas, visual growth charts, and detailed schedules, it empowers Indian investors to make informed decisions.

Understanding compound interest today leads to stronger financial freedom tomorrow.

References Site Links