Future Value Calculator

Results

| Period | Start Balance | Deposit | Interest | End Balance |

|---|

Use our free Future Value Calculator to see how much your investments and savings will be worth in the future. Learn the FV formula and plan for your financial goals.

Future Value Calculator: What It Is, How to Use It, and Why It Matters for Your Investments

In the world of personal finance and investing, understanding how your money can grow over time is crucial. That’s where a Future Value Calculator comes in. Whether you’re planning for retirement, saving for a big purchase, or evaluating investment options, this tool helps you forecast the future worth of your investments, including interest and regular deposits. In this comprehensive guide, we’ll break down what a Future Value Calculator is, the underlying FV formula, how to use it step-by-step, and much more. Plus, we’ve embedded a free, interactive Future Value Calculator right here for you to try!

What is Future Value (FV)?

Future Value (FV) is a financial concept that calculates how much an investment or sum of money will be worth at a specific point in the future, assuming a certain interest rate and compounding periods. It accounts for the time value of money—the idea that a dollar today is worth more than a dollar tomorrow due to its earning potential.

Why does this matter? Imagine investing $1,000 today at a 6% annual interest rate. Without additional deposits, it could grow significantly over 10 years. But add regular deposits (like monthly contributions to a savings account), and the growth explodes. A Future Value Calculator simplifies these projections, helping you make informed decisions about savings, loans, or retirement plans.

- Key Benefits: Predicts growth, compares investment scenarios, and aids in financial planning.

- Common Uses: Retirement planning, education savings, real estate investments, and more.

For more on the basics, check out this Investopedia guide on Future Value.

Breaking Down the Components of the FV Calculator

To accurately project your investment’s future worth, the calculator needs a few key pieces of information. Let’s break down each input.

Starting Amount (PV – Present Value)

This is the amount of money you have right now. It could be your current savings balance, the initial amount of a new investment, or your existing retirement fund balance.

Number of Periods (N)

This is the total length of time you plan to let your investment grow. The periods are typically measured in years, but they can also be months or quarters, depending on how frequently your interest compounds and you make deposits.

Interest Rate (I/Y – Interest/Yield)

This is the annual rate of return you expect to earn on your investment. For a savings account, this might be a fixed rate. For stocks or mutual funds, you would use an estimated average annual return. Remember, this is an estimate, and actual returns can vary.

Periodic Deposit (PMT – Payment)

This is the regular, additional amount of money you plan to contribute to your investment. For example, this could be the $500 you transfer to your retirement account every month. Consistent contributions are a powerful engine for growth.

Payment Timing (Beginning vs. End of Period)

This crucial detail determines when your periodic deposits start earning interest.

- Beginning (Annuity Due): Your contribution is made at the start of the period (e.g., January 1st). This gives your money the entire period to earn interest, resulting in a slightly higher future value. This is common for things like rent or lease payments.

- End (Ordinary Annuity): Your contribution is made at the end of the period (e.g., December 31st). This is the standard for many retirement savings plans where contributions are made from a paycheck.

The Future Value Formula Explained

At its core, the FV calculation uses mathematical formulas that differ based on whether you’re dealing with a lump sum or regular payments (annuities). Here’s a breakdown:

Basic FV Formula for Lump Sum

For a single starting amount (Present Value or PV) with compound interest:

FV = PV × (1 + i)^N

- PV: Starting amount (e.g., $1,000).

- i: Periodic interest rate (e.g., 6% annual = 0.06).

- N: Number of periods (e.g., 10 years).

FV Formula with Regular Deposits (Annuities)

If you’re making periodic deposits (PMT), the formula adjusts for when payments are made:

Ordinary Annuity (Payments at End of Period)

FV = PV × (1 + i)^N + PMT × [((1 + i)^N - 1) / i]

Annuity Due (Payments at Beginning of Period)

FV = PV × (1 + i)^N + PMT × [((1 + i)^N - 1) / i] × (1 + i)

These formulas account for compounding, where interest earns interest. Our Future Value Calculator handles both types automatically—no math required!

How to Use a Future Value Calculator: Step-by-Step Guide

Using a Future Value Calculator is straightforward. Our free tool below is responsive, supports multiple currencies ($ € £ ₹ ¥), and includes visualizations like pie charts and stacked bar graphs. Here’s how to get started:

- Select Your Currency: Choose from USD ($), EUR (€), GBP (£), INR (₹), or JPY (¥) using the tabs. This updates all displays visually (calculations remain the same).

- Enter Number of Periods (N): This is the time frame (e.g., 10 years).

- Input Starting Amount (PV): Your initial investment (e.g., $1,000).

- Set Interest Rate (I/Y %): Annual rate (e.g., 6%).

- Add Periodic Deposit (PMT): Regular contributions (e.g., $100 per period).

- Choose Payment Timing: “Beginning” (Annuity Due) or “End” (Ordinary Annuity).

- Click Calculate: See instant results, including FV, breakdowns, charts, and a detailed schedule.

- Export Data: Download the schedule as a CSV file for Excel or further analysis.

Pro Tip: Experiment with different inputs to see how small changes (like increasing PMT) impact your future wealth. If you clear the form, it resets to defaults.

Example Calculation Using the Future Value Calculator

Let’s walk through a real example with default values:

- N: 10 periods

- PV: $1,000

- I/Y: 6%

- PMT: $100 (at beginning of period)

After clicking “Calculate,” you might see:

- Future Value: Approximately $3,188.01

- Total Deposits: $1,000 (PMT × N)

- Total Interest: $1,188.01

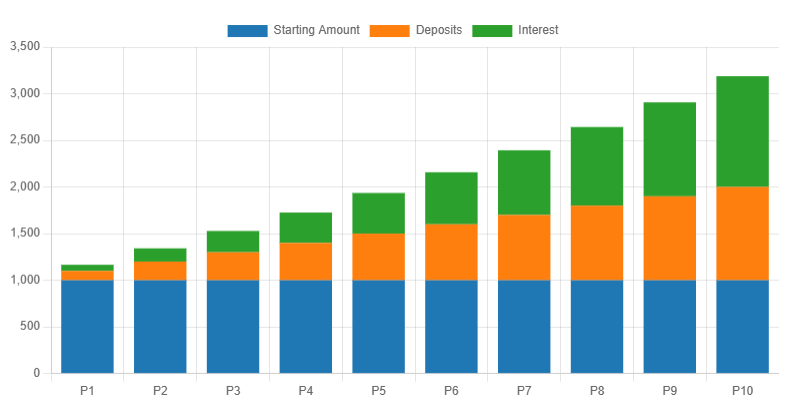

The pie chart breaks down the FV into starting amount, deposits, and interest. The stacked bar chart shows growth period-by-period, and the table details each step. Export it as CSV to analyze in a spreadsheet!

| Period | Start Balance | Deposit | Interest | End Balance |

|---|---|---|---|---|

| 1 | $1,000.00 | $100.00 | $66.00 | $1,166.00 |

| 2 | $1,166.00 | $100.00 | $75.96 | $1,341.96 |

| 3 | $1,341.96 | $100.00 | $86.52 | $1,528.48 |

| 4 | $1,528.48 | $100.00 | $97.71 | $1,726.19 |

| 5 | $1,726.19 | $100.00 | $109.57 | $1,935.76 |

| 6 | $1,935.76 | $100.00 | $122.15 | $2,157.90 |

| 7 | $2,157.90 | $100.00 | $135.47 | $2,393.38 |

| 8 | $2,393.38 | $100.00 | $149.60 | $2,642.98 |

| 9 | $2,642.98 | $100.00 | $164.58 | $2,907.56 |

| 10 | $2,907.56 | $100.00 | $180.45 | $3,188.01 |

Understanding the Outputs: Charts, Tables, and More

Our calculator goes beyond basic numbers:

- Pie Chart: Visualizes the FV composition (e.g., 31% starting amount, 31% deposits, 38% interest).

- Stacked Bar Chart: Shows accumulated value over periods, stacked by components.

- Schedule Table: Period-by-period breakdown of balances, deposits, and interest.

These visuals make complex data easy to understand, helping you spot trends like accelerating interest growth.

Benefits of Using a Future Value Calculator for Financial Planning

Why bother with an investment calculator like this?

- Accurate Forecasting: Avoid manual errors in FV calculations.

- Scenario Testing: Compare “what if” scenarios, like higher interest rates.

- Multi-Currency Support: Ideal for international investors.

- Export and Share: Save results for reports or advisors.

- Free and Accessible: No software needed—works on any device.

Studies show that regular use of tools like this can improve savings habits by up to 20% (source: Financial Planning Association).

Common Mistakes to Avoid When Calculating Future Value

Don’t fall into these traps:

- Ignoring compounding frequency (our tool assumes annual, but adjust N for monthly).

- Forgetting taxes or inflation—use net rates for realism.

- Mixing up annuity types: “Beginning” assumes deposits earn interest immediately.

Frequently Asked Questions (FAQs)

What is the difference between ordinary annuity and annuity due?

Ordinary annuity payments are at the end of the period; annuity due at the beginning, earning extra interest.

Can this calculator handle negative interest rates?

Yes, but negative rates are rare – input them as usual.

Is this tool accurate for real investments?

It’s based on standard formulas but doesn’t account for fees or market volatility. Consult a financial advisor for personalized advice.

What’s a realistic interest rate to use?

For long-term stock market investments, a historical average is often cited between 7-10%, but this is not guaranteed. For high-yield savings or bonds, use the rate offered by the institution. It’s wise to be slightly conservative with your estimates.

How does inflation affect future value?

This calculator shows the nominal future value, not the “real” future value adjusted for inflation. To estimate the real value, you can subtract the expected inflation rate from your interest rate (e.g., 7% return – 3% inflation = 4% real return).

Can I use this for a loan?

No. This calculator is designed for the growth of savings and investments. Loan calculators use different formulas to determine amortization schedules.

Conclusion: Start Planning Your Financial Future Today

A Future Value Calculator is an essential tool for anyone serious about growing their wealth. By understanding how your investments compound over time, you can make smarter decisions and achieve your goals faster. Try our free calculator above, experiment with your numbers, and export your results to build a solid plan.

Have questions or need more tools? Check out our other calculators like Present Value Calculator or leave a comment below. Don’t forget to share this article if it helped!

Disclaimer: This tool is for educational purposes only and not financial advice. Always verify with professionals.