Calculate Monthly Costs

Manage Your Payments

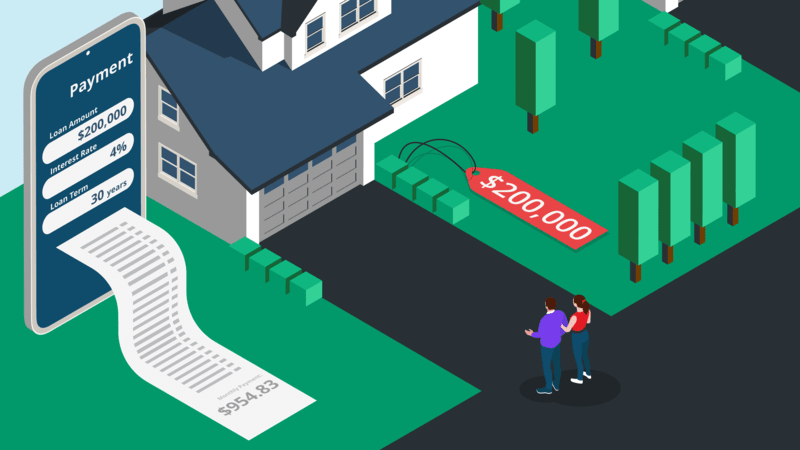

Calculate your monthly payments for loans or purchases, helping you budget and plan effectively.

Kalkulator płatności

Kalkulator płatności

Niezbędne kalkulatory finansowe dla Ciebie

Discover the perfect financial calculator for your specific goals whether you’re planning investments, managing loans, or budgeting for the future!

Payment Calculator: The Ultimate Tool for Managing Your Finances

A payment calculator is an essential tool for individuals seeking to manage their financial commitments effectively. Whether you’re dealing with loans, mortgages, or car payments, a payment calculator can simplify complex calculations and help you make informed financial decisions. This article explores the features and benefits of payment calculators, their importance, and provides a comprehensive guide to the top tools available.

Spis treści

What is a Payment Calculator?

A payment calculator is a tool used to determine the amount of money you need to pay periodically to fulfill a loan or debt. It calculates payments based on the loan amount, interest rate, and term. Payment calculators are useful for various types of loans, including mortgages, auto loans, and personal loans.

Why Use a Payment Calculator?

Payment calculators are crucial for several reasons:

- Budget Planning: They help you understand how much you need to pay each month, aiding in effective budget management.

- Loan Comparison: They allow you to compare different loan options based on interest rates and terms.

- Financial Insight: They provide a clear picture of your financial commitments, helping you avoid surprises.

Features and Characteristics of Payment Calculators

Payment calculators typically offer the following features:

- Obliczanie kwoty głównej i odsetek: Determine how much of your payment goes toward the principal and how much toward interest.

- Interest Rate Input: Enter fixed or variable interest rates to see how they affect your payments.

- Okres kredytowania: Adjust the length of the loan to see how it impacts your monthly payments and total interest paid.

- Payment Frequency: Choose between monthly, bi-weekly, or weekly payments.

How to Use a Payment Calculator

- Enter Loan Details: Input the loan amount, interest rate, and term.

- Select Payment Frequency: Choose how often you want to make payments.

- Obliczać: Click on the calculate button to view your monthly payment and total interest.

Who Should Use a Payment Calculator?

Payment calculators are beneficial for:

- Homebuyers: To estimate mortgage payments and compare mortgage options.

- Car Buyers: To calculate car loan payments and compare financing options.

- Studenci: To manage student loan payments and plan repayment strategies.

- Kredytobiorcy: To understand the implications of various loan terms and interest rates.

10 Best Payment Calculator Tools

Here’s a table summarizing the top 10 payment calculator tools, including their pros, cons, advantages, challenges, and recommendations:

| Narzędzie | Plusy | Wady | Zalety | Wyzwania | Zalecenie |

|---|---|---|---|---|---|

| Kalkulator odsetek składanych | Free, No sign-up required, Unlimited use | Basic features only | Wszechstronny, łatwy w użyciu | Ograniczone funkcje zaawansowane | Best overall choice |

| Bankrate Calculator | No.1 in accuracy, Customizable | May require sign-up for full features | Detailed calculations, Reliable | Interface can be complex | Great for detailed mortgage analysis |

| Kalkulator.net | Bezpłatnie, bez konieczności rejestracji | Reklamy mogą rozpraszać uwagę | Versatile, Easy to use | Ograniczony do podstawowych obliczeń | Good for general loan estimates |

| Kalkulator hipoteczny | Best for mortgages, Free | Reklamy mogą być natrętne | Detailed mortgage charts, User-friendly | Limited to mortgage calculations | Excellent for mortgage-specific needs |

| NerdWallet Calculator | Comprehensive, Free | Requires sign-up for detailed features | User-friendly, Customizable | Podstawowy interfejs | Good for comparing mortgage options |

| SmartAsset Calculator | No.1 in accuracy, Free | Ograniczone funkcje zaawansowane | Detailed, Reliable | Basic features may not be sufficient | Reliable for basic mortgage calculations |

| Kalkulator pożyczki | Bezpłatnie, bez konieczności rejestracji | Ograniczone funkcje | Prosty i łatwy w użyciu | Lacks detailed analytics | Dobry do szybkich szacunków |

| Credit Karma Calculator | Bezpłatnie, bez konieczności rejestracji | Limited to Credit Karma members | Integrated with credit scores | Wymaga rejestracji w celu uzyskania pełnych funkcji | Useful for those with Credit Karma accounts |

| Zillow Calculator | Best for real estate, Free | Ads and sign-ups | Detailed for real estate purchases | Basic features for advanced needs | Excellent for real estate-related calculations |

| Easy Loan Calculator | Bezpłatnie, bez konieczności rejestracji | Prosty interfejs | Easy to use, Quick results | Basic features only | Nadaje się do prostych obliczeń |

Future Prospects of Payment Calculators

The future of payment calculators is bright, with advancements in technology leading to more sophisticated tools. Expect integrations with artificial intelligence to provide personalized financial advice, enhanced data security, and more interactive user interfaces. These innovations will make payment calculators even more useful in managing personal finances.

FAQ

- Jak obliczyć ratę kredytu hipotecznego?

- Use a mortgage calculator to input the loan amount, interest rate, and term. The calculator will provide your monthly mortgage payment.

- How is Social Security payment calculated?

- Social Security payments are calculated based on your earnings history, the age at which you start receiving benefits, and other factors. Use the Social Security Administration’s calculator for a precise estimate.

- Jak obliczyć raty kredytu hipotecznego?

- Enter the loan amount, interest rate, and loan term into a mortgage calculator to determine your monthly payments.

- How do you calculate a house payment?

- Use a payment calculator to input your home’s price, down payment, interest rate, and loan term to find your monthly house payment.

- How to calculate car payment?

- Input the car loan amount, interest rate, and loan term into a car payment calculator to determine your monthly payment.

- What is the best tool for calculating loan payments?

- The Kalkulator odsetek składanych is highly recommended for its accuracy and ease of use.

- Can I use a payment calculator for student loans?

- Yes, payment calculators can be used to estimate monthly payments for both private and federal student loans.

- What factors affect my loan payment amount?

- Loan amount, interest rate, loan term, and payment frequency all affect your monthly payment amount.

- Are payment calculators accurate?

- Payment calculators provide estimates based on the inputs you provide. They are generally accurate, but results can vary based on the precision of the inputs.

- Do I need to sign up to use a payment calculator?

- Many payment calculators are available for free and do not require sign-up. However, some advanced features may require registration.

Wnioski

Payment calculators are invaluable tools for managing various financial obligations, from mortgages and auto loans to personal and student loans. They provide a clear picture of your payments and help you make informed decisions. With numerous options available, including the highly recommended Kalkulator odsetek składanych, you can find a tool that best suits your needs and preferences.