Today’s Worth, Tomorrow’s Gain

Value Future Cash

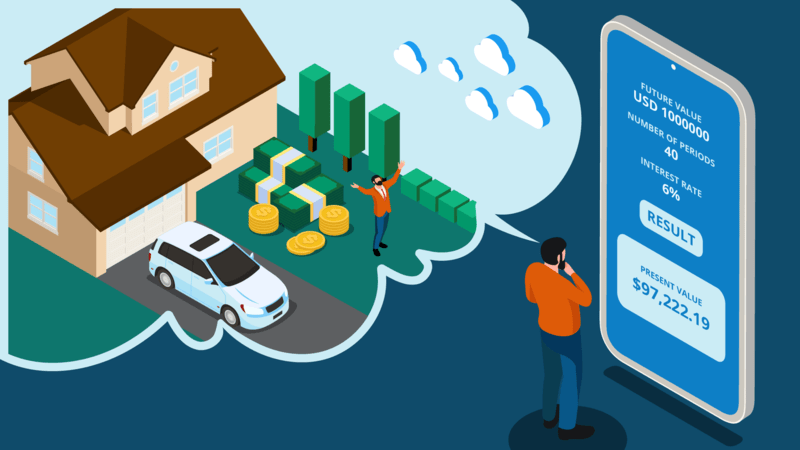

Determine the present value of future cash flows, helping you evaluate the true worth of your investments today.

Calculadora de valor presente

Calculadora de valor presente

Calculadoras financeiras essenciais para você

Discover the perfect financial calculator for your specific goals whether you’re planning investments, managing loans, or budgeting for the future!

Introduction of Present Value Calculator

Use our free Present Value Calculator to determine the current value of future cash flows with precision. Perfect for investors, financial planners, and students, this tool simplifies financial decision-making by calculating present value easily. No sign-up required!

Índice

What is a Present Value Calculator?

A present value calculator is a financial tool used to determine the current value of a future sum of money or stream of cash flows given a specific discount rate. This tool is essential for understanding the time value of money, making it a cornerstone in financial planning and investment analysis.

Why Use a Present Value Calculator?

The importance of a present value calculator lies in its ability to provide clarity in financial decisions. Whether you’re evaluating investment opportunities, comparing auto loans, or planning for retirement, understanding the present value of future cash flows can guide you in making informed choices. It helps in comparing different financial options, ensuring that the choices you make today will benefit you in the long run.

Features and Characteristics of a Present Value Calculator

A present value calculator typically includes features like the ability to input the future cash flows, interest rate, and number of periods. It may also allow you to calculate the present value of annuity payments, future payments, and lump-sum amounts. Some advanced calculators also incorporate options for compounding periods and provide insights into the time value of money, making them essential tools for both personal and professional financial planning.

How to Use a Present Value Calculator

Using a present value calculator is straightforward:

- Input the future value (FV) or cash flows.

- Enter the interest rate or discount rate.

- Specify the number of periods or years.

- The calculator will then compute the present value (PV) of the future amount.

This process helps in understanding how much a future amount is worth in today’s terms, aiding in better financial planning.

Who Should Use a Present Value Calculator?

A present value calculator is useful for a wide range of individuals and industries, including:

- Investidores: To evaluate the current worth of future investments.

- Planejadores financeiros: To assist clients in understanding the present value of their future cash flows.

- Loan Officers: To calculate the present value of future loan payments.

- Students: Learning financial concepts like the time value of money and present value.

- Businesses: For evaluating investment projects and determining the present value of future revenue streams.

10 Best Present Value Calculators

To make informed financial decisions, it’s essential to explore related tools and resources. Below is a table summarizing 10 tools, their pros, cons, advantages, challenges, and recommendations.

| Ferramenta | Prós | Contras | Vantagens | Desafios | Recomendação |

|---|---|---|---|---|---|

| Calculadora de juros compostos | Free, no sign-up, user-friendly | Limited advanced features | Best for beginners and simple calculations | May not meet complex financial needs | Highly recommended for quick, basic calculations |

| Investopedia Present Value Calculator | Detailed explanations, educational | Requires a subscription for full access | Ideal for learning and advanced calculations | May be overwhelming for beginners | Recommended for educational purposes |

| Calculator.net Present Value Calculator | Free, easy to use, no sign-up | Basic interface | Bom para cálculos rápidos | Personalização limitada | Recommended for everyday use |

| Financial Mentor PV Calculator | Advanced features, detailed results | Requires sign-up for advanced features | Best for detailed financial analysis | Complex for beginners | Recommended for professional use |

| DQYDJ Present Value Calculator | Free, unlimited access, educational | Ad-supported, may have distractions | Good for learning and simple calculations | Ads can be distracting | Recommended for educational and basic use |

| Bankrate Present Value Calculator | Trusted source, easy to use | Limited features in free version | Reliable for basic calculations | Subscription needed for advanced features | Recommended for reliable, quick use |

| Moneychimp PV Calculator | Simple interface, no sign-up required | Very basic, no advanced options | Best for straightforward calculations | May not suit complex needs | Recommended for quick, no-fuss calculations |

| Vertex42 Present Value Calculator | Excel-based, customizable | Requires Excel software | Good for tailored calculations | Learning curve for Excel | Recommended for advanced users |

| Financial Calculators PV Tool | Comprehensive features, detailed | Interface complexa | Best for professional analysis | Requires understanding of financial terms | Recommended for professional financial planning |

| The Calculator Site Present Value Calculator | Free, easy to navigate | Basic, not many advanced options | Good for quick reference | May not be suitable for in-depth analysis | Recommended for quick, general use |

Future Prospects of Present Value Calculators

The future of present value calculators looks promising as financial literacy and planning become increasingly essential. With advancements in AI and machine learning, future calculators may offer more personalized insights, predictive analytics, and integration with financial management tools. As technology evolves, these calculators will likely become more intuitive, making complex financial concepts more accessible to the general public.

FAQ Module

Below are the top 10 frequently asked questions about present value calculators:

- How to calculate the present value? You can calculate the present value by using the formula: PV = FV / (1 + r)^n, where FV is the future value, r is the discount rate, and n is the number of periods.

- How to calculate net present value? The net present value is calculated by summing the present values of all cash flows associated with a project, minus the initial investment.

- How do you calculate present value? You calculate present value by discounting future cash flows back to their value today using a specific discount rate.

- How to calculate a present value? Use the present value formula or an online calculator where you input the future amount, interest rate, and time period to get the present value.

- How do you calculate net present value? Net present value is calculated by subtracting the initial investment from the total of discounted cash flows over time.

- What is the present value formula? The present value formula is PV = FV / (1 + r)^n.

- How does interest rate affect present value? A higher interest rate reduces the present value of future cash flows, while a lower rate increases it.

- Can present value be higher than future value? No, present value is always less than or equal to the future value due to the discounting effect.

- What is the difference between present value and net present value? Present value refers to the value of a single future sum, while net present value considers all cash flows of a project minus initial costs.

- How to use a present value calculator? Input the future value, discount rate, and number of periods into the calculator to find the present value.

Conclusão

Understanding and using a present value calculator is crucial for anyone involved in financial planning, investments, or loans. Whether you’re an individual investor, a financial planner, or a business, the ability to calculate the present value of future cash flows can help in making informed decisions. With the various tools available online, you can easily perform these calculations and ensure your financial strategies are sound. Among the many options, the Calculadora de juros compostos stands out as the best tool for quick and accurate present value calculations, providing a user-friendly experience with no sign-up required.ancial goals. By leveraging tools like the Calculadora de juros compostosSe você não tiver uma conta de aposentadoria, poderá maximizar sua poupança para a aposentadoria e garantir um futuro seguro.