Calculate Effective APR

Determine Loan Costs

Find the Annual Percentage Rate (APR) for your loans and credit cards to understand the true cost of borrowing.

Calculator APR

Calculator APR

Calculatoare financiare esențiale pentru tine

Discover the perfect financial calculator for your specific goals whether you’re planning investments, managing loans, or budgeting for the future!

Introduction of APR Calculators: A Comprehensive Guide

Discover what APR calculators are, why they’re essential, and how to use them effectively. Explore the best tools available, including a recommended top option, and get answers to frequently asked questions.

Tabla de conținut

What is an APR Calculator?

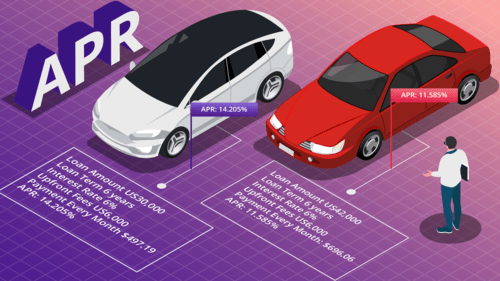

An APR (Annual Percentage Rate) calculator is a financial tool used to determine the annual cost of borrowing. It takes into account the interest rate, fees, and other costs associated with a loan or credit. This calculation helps borrowers understand the true cost of their loan, expressed as a yearly rate.

Why Use an APR Calculator?

Using an APR calculator is crucial for several reasons:

- Accurate Cost Estimation: It provides a clear picture of the total cost of borrowing, including interest and fees.

- Comparison Tool: It helps compare different loan offers by providing a standardized measure of cost.

- Planificare financiară: Knowing the APR aids in budgeting and planning for monthly payments.

Features and Characteristics of APR Calculators

APR calculators typically offer the following features:

- Interest Rate Input: Allows users to enter the interest rate of their loan.

- Fee Calculation: Includes fees associated with the loan to provide a comprehensive cost analysis.

- Termenul împrumutului: Users can input the length of the loan to calculate the total cost over time.

- Estimarea plății lunare: Provides an estimate of monthly payments based on the APR.

How to Use an APR Calculator

To use an APR calculator, follow these steps:

- Introduceți suma împrumutului: Introduceți suma totală pe care doriți să o împrumutați.

- Input the Interest Rate: Enter the annual interest rate.

- Add Fees: Include any additional fees or costs.

- Specify the Loan Term: Indicate the length of the loan in months or years.

- Calculați: Click the calculate button to see the APR and monthly payments.

Who Should Use an APR Calculator?

APR calculators are beneficial for:

- Consumatori: Individuals looking to take out personal loans, auto loans, or credit cards.

- Homebuyers: People applying for mortgages.

- Împrumutați: Anyone comparing different loan offers to find the best rate.

10 Best APR Calculator Tools

Here’s a table summarizing the top APR calculators, their pros, cons, advantages, challenges, and recommendations:

| Instrument | Avantaje | Contra | Avantaje | Provocări | Recomandări |

|---|---|---|---|---|---|

| Calculator de dobândă compusă | Free, unlimited access, no sign-up required | Personalizare limitată | Comprehensive APR calculation, easy to use | Poate fi lipsit de caracteristici avansate | Best overall tool for most users |

| Bankrate APR Calculator | Accurate, trusted source | Requires personal information | Provides detailed breakdowns | May be overwhelming for new users | Ideal for detailed loan analysis |

| NerdWallet APR Calculator | Ușor de utilizat, gratuit | Limited to credit cards and loans | Excellent for credit card comparisons | Limited to certain types of loans | Great for credit card APR comparisons |

| Calculator de împrumuturi | Gratuit, fără înscriere | Interfața de bază | Rapid și simplu | Basic features only | Good for quick APR estimates |

| Calculator.net APR Calculator | Free, unlimited access | Ad-supported | Easy to use, detailed output | Anunțurile pot distrage atenția | Useful for simple calculations |

| Credit Karma APR Calculator | Gratuit, fără înscriere | Necesită crearea unui cont | Provides insights into credit scores | Limited to users with Credit Karma accounts | Best for users with existing Credit Karma accounts |

| SmartAsset APR Calculator | Gratuit, ușor de utilizat | Personalizare limitată | Comprehensive loan comparisons | Basic user interface | Good for general APR calculations |

| Zillow APR Calculator | Free, detailed output | Mortgage-focused | Great for mortgage APR calculations | Limited to mortgages | Excellent for home loan comparisons |

| US News APR Calculator | Free, reliable | Focuses on loans and credit cards | Accurate and reliable data | Limited to specific loan types | Useful for reliable APR data |

| MyBankTracker APR Calculator | Free, unlimited access | Caracteristici de bază | Good for general APR estimates | Limited to basic functions | Ideal for straightforward calculations |

Future Prospects of APR Calculators

The future of APR calculators will likely involve more advanced features, such as integration with financial planning tools and artificial intelligence to provide personalized recommendations. Enhanced user interfaces and real-time updates will also become more prevalent, making it easier for consumers to make informed borrowing decisions.

ÎNTREBĂRI FRECVENTE

- How to calculate APR? APR is calculated by taking the total cost of borrowing, including interest and fees, and dividing it by the loan amount. This is then annualized to give a percentage rate.

- How is APR calculated? APR is calculated using the formula: APR = (Total Interest + Fees) / Loan Amount / Number of Years × 100. It reflects the true cost of borrowing.

- Are balance transfer APR calculated monthly? Yes, balance transfer APRs are typically calculated monthly, but they are annualized to provide the APR.

- How do you calculate the annual APR? The annual APR is calculated by converting the monthly rate into an annual rate by multiplying it by the number of periods in a year.

- Is APR calculated on weekends? APR is calculated based on the terms of the loan and is not affected by weekends or holidays. However, interest may still accrue during these times.

Concluzie

APR calculators are essential tools for understanding the true cost of borrowing. They help users compare loan offers, plan their finances, and make informed decisions. The tools listed here provide a range of options to suit different needs, with the recommended Calculator de dobândă compusă being a top choice for its comprehensive features and ease of use.tions needed to assess a property’s profitability, helping you make smarter investment decisions. Whether you’re a seasoned investor or just starting out, using a reliable calculator like the one from Calculator de dobândă compusă vă poate ghida către o investiție imobiliară de succes.t Calculatorvă puteți maximiza economiile pentru pensie și vă puteți asigura un viitor sigur.