Calculate Monthly Payments

Finance Your Vehicle

Estimate your monthly payments and total interest costs for auto loans, ensuring you can comfortably finance your next vehicle.

汽车贷款计算器

汽车贷款计算器

您必备的财务计算器

Discover the perfect financial calculator for your specific goals whether you’re planning investments, managing loans, or budgeting for the future!

Auto Loan Calculator: The Ultimate Tool for Car Buyers

Discover the best Auto Loan Calculator tools, their benefits, and how to use them effectively. Learn how to calculate auto loan payments and find the best tools online.

目录

What is an Auto Loan Calculator?

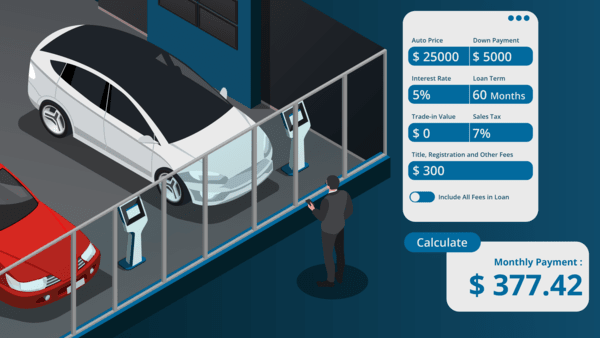

An 汽车贷款计算器 is a tool designed to help car buyers estimate their monthly loan payments based on factors such as loan amount, interest rate, loan term, and sales tax. This tool is essential for anyone considering financing a vehicle, whether new or used. It allows buyers to input various parameters to get an accurate estimate of what their monthly payments will be, helping them make informed decisions.

Why Use an Auto Loan Calculator?

Using an 汽车贷款计算器 is crucial for anyone planning to finance a car purchase. Here’s why:

- Accurate Budgeting: By calculating the monthly payments, you can better understand your financial commitment and ensure it fits within your budget.

- Interest Insights: It helps you understand how different interest rates affect your payments.

- Comparison Shopping: With an auto loan calculator, you can compare offers from banks, credit unions, and other lenders to find the best deal.

- Payment Estimation: It helps estimate monthly payments based on different loan terms, which can be essential for long-term financial planning.

- No Surprises: Knowing your payment schedule and total cost helps avoid surprises down the road.

Features and Characteristics of Auto Loan Calculators

Auto Loan Calculators come with a variety of features that make them indispensable tools for car buyers:

- Loan Amount Input: Users can input the total loan amount they plan to borrow.

- Interest Rate Calculation: Calculates how much interest will accrue over the life of the loan.

- Loan Term Options: Allows users to choose different loan terms, such as 36, 60, or 84 months.

- Sales Tax Inclusion: Some calculators include sales tax to give a more accurate payment estimate.

- Extra Payments: Advanced calculators allow users to factor in extra payments to see how they affect the loan term.

- Amortization Schedule: Provides a detailed schedule of payments, showing the remaining balance after each payment.

How to Use an Auto Loan Calculator

Using an Auto Loan Calculator is straightforward. Here’s a step-by-step guide:

- Enter the Loan Amount: Input the total amount you wish to borrow.

- 设置利率: Enter the interest rate offered by your lender.

- Choose the Loan Term: Select the length of the loan term, typically ranging from 36 to 84 months.

- Include Sales Tax: If the calculator allows, include the sales tax rate for a more accurate calculation.

- 计算: Click on the calculate button to see your estimated monthly payments.

- Adjust as Needed: Experiment with different loan amounts, terms, and interest rates to find the best option for your budget.

Who Should Use an Auto Loan Calculator?

Auto Loan Calculators are beneficial for various individuals and industries, including:

- First-Time Car Buyers: Those new to car buying can use the calculator to understand their financial commitment.

- Used Car Buyers: It helps in estimating payments for used cars with varying interest rates.

- Car Dealerships: Dealers can use these tools to show potential buyers their payment options.

- Financial Advisors: Advisors can use these calculators to provide clients with accurate financial plans for purchasing a car.

- Loan Officers: Loan officers can use the calculator to help clients understand their loan terms.

- Budget-Conscious Consumers: Anyone looking to make an informed financial decision when purchasing a vehicle.

10 Best Auto Loan Calculator Tools

Here are the top 10 Auto Loan Calculator tools, along with their pros, cons, advantages, challenges, and recommendations:

| 工具 | 优点 | 缺点 | 优势 | 挑战 | 建议 |

|---|---|---|---|---|---|

| 1. https://compoundinterestcalculator.site/loan/auto-loan-calculator/ | Free, easy to use, no sign-up required | 有限的定制 | Best for quick calculations | Not suitable for complex loans | Highly recommended for quick estimations |

| 2. Bankrate Auto Loan Calculator | Comprehensive, includes amortization schedule | 广告会分散注意力 | Great for detailed loan analysis | May require multiple inputs | Recommended for detailed calculations |

| 3. Edmunds Auto Loan Calculator | Includes vehicle price estimator | Limited to car purchases | Useful for buying new cars | Limited to specific brands | Best for new car buyers |

| 4. Cars.com Auto Loan Calculator | User-friendly, includes trade-in options | Lacks extra payment options | Good for basic loan calculations | Limited loan terms | Recommended for first-time buyers |

| 5. NerdWallet Auto Loan Calculator | Includes credit score analysis | Limited to standard loan terms | Ideal for credit score comparisons | Not suitable for long-term loans | Recommended for comparing loan options |

| 6. Credit Karma Auto Loan Calculator | Integrates with credit monitoring | Requires account sign-up | Best for credit-conscious buyers | Limited to standard loan options | Recommended for those focused on credit impact |

| 7. Capital One Auto Loan Calculator | Includes pre-qualification options | Limited to Capital One loans | Ideal for Capital One customers | Limited to bank’s products | Recommended for Capital One customers |

| 8. AutoTrader Auto Loan Calculator | Includes vehicle comparison tool | Lacks extra payment options | Great for vehicle comparisons | Not suitable for refinancing | Recommended for buyers comparing vehicles |

| 9. Chase Auto Loan Calculator | Includes dealership financing options | Limited to Chase products | Best for Chase customers | 有限的定制 | Recommended for Chase customers |

| 10. Kelley Blue Book Auto Loan Calculator | Integrates with car valuation tools | Limited to specific lenders | Great for estimating vehicle value | Limited to certain lenders | Recommended for valuing and financing vehicles |

Future Prospects of Auto Loan Calculators

The future of Auto Loan Calculators is promising, with advancements in technology leading to more accurate and user-friendly tools. Integration with AI could allow for personalized loan recommendations, and enhanced features like real-time interest rate comparisons and predictive analytics could provide even more value to users. As the automotive industry continues to evolve, these calculators will become even more essential for buyers looking to make informed financial decisions.

常见问题

- How to calculate auto loan interest?

To calculate auto loan interest, multiply the loan balance by the interest rate. Divide by the number of periods in a year (usually 12 for monthly payments) to get the monthly interest amount. - How to calculate auto loan payment?

Use an auto loan calculator where you input the loan amount, interest rate, and term to get your monthly payment. - How to calculate an auto loan payment manually?

Use the formula:P = [r*PV] / [1 - (1 + r)^-n], wherePis the monthly payment,ris the monthly interest rate,PVis the loan amount, andnis the number of payments. - How to calculate an auto loan?

Determine the loan amount, interest rate, and term, then use an auto loan calculator or the manual formula to calculate monthly payments. - How to calculate auto loan monthly payment?

Input the loan amount, interest rate, and loan term into an auto loan calculator to get the monthly payment. - What is the best auto loan calculator?

The best auto loan calculator depends on your needs, but tools like the one provided by 复利计算器 are highly recommended for quick and accurate results. - Can I calculate extra payments with an auto loan calculator?

Yes, some calculators allow you to input extra payments to see how they affect your loan term. - How does the loan term affect my monthly payments?

Longer loan terms typically result in lower monthly payments but may lead to higher total interest paid over the life of the loan. - What factors should I consider when choosing an auto loan calculator?

Consider ease of use, features like extra payment options, and whether it includes an amortization schedule. - Is it better to finance through a bank or dealership?

It depends on the interest rates and terms offered. Use an auto loan calculator to compare offers from banks and dealerships.

结论

Auto Loan Calculators are essential tools for anyone looking to finance a car. They provide accurate estimates of monthly payments, helping buyers make informed decisions. With various calculators available, it’s important to choose one that best suits your needs. For quick and accurate calculations, consider using the 复利计算器, which offers a user-friendly experience without requiring sign-up. As the automotive and financial industries continue to evolve, these tools will only become more valuable for consumers.