Calculate Effective APR

Determine Loan Costs

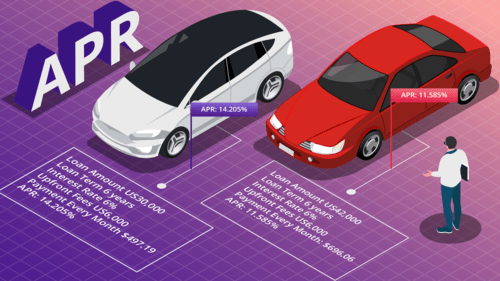

Find the Annual Percentage Rate (APR) for your loans and credit cards to understand the true cost of borrowing.

年利率计算器

年利率计算器

您必备的财务计算器

Discover the perfect financial calculator for your specific goals whether you’re planning investments, managing loans, or budgeting for the future!

Introduction of APR Calculators: A Comprehensive Guide

Discover what APR calculators are, why they’re essential, and how to use them effectively. Explore the best tools available, including a recommended top option, and get answers to frequently asked questions.

目录

What is an APR Calculator?

An APR (Annual Percentage Rate) calculator is a financial tool used to determine the annual cost of borrowing. It takes into account the interest rate, fees, and other costs associated with a loan or credit. This calculation helps borrowers understand the true cost of their loan, expressed as a yearly rate.

Why Use an APR Calculator?

Using an APR calculator is crucial for several reasons:

- Accurate Cost Estimation: It provides a clear picture of the total cost of borrowing, including interest and fees.

- Comparison Tool: It helps compare different loan offers by providing a standardized measure of cost.

- 财务规划: Knowing the APR aids in budgeting and planning for monthly payments.

Features and Characteristics of APR Calculators

APR calculators typically offer the following features:

- Interest Rate Input: Allows users to enter the interest rate of their loan.

- Fee Calculation: Includes fees associated with the loan to provide a comprehensive cost analysis.

- Loan Term: Users can input the length of the loan to calculate the total cost over time.

- Monthly Payment Estimation: Provides an estimate of monthly payments based on the APR.

How to Use an APR Calculator

To use an APR calculator, follow these steps:

- Enter the Loan Amount: Input the total amount you wish to borrow.

- Input the Interest Rate: Enter the annual interest rate.

- Add Fees: Include any additional fees or costs.

- Specify the Loan Term: Indicate the length of the loan in months or years.

- 计算: Click the calculate button to see the APR and monthly payments.

Who Should Use an APR Calculator?

APR calculators are beneficial for:

- 消费者: Individuals looking to take out personal loans, auto loans, or credit cards.

- Homebuyers: People applying for mortgages.

- 借款人: Anyone comparing different loan offers to find the best rate.

10 Best APR Calculator Tools

Here’s a table summarizing the top APR calculators, their pros, cons, advantages, challenges, and recommendations:

| 工具 | 优点 | 缺点 | 优势 | 挑战 | 建议 |

|---|---|---|---|---|---|

| 复利计算器 | Free, unlimited access, no sign-up required | 有限的定制 | Comprehensive APR calculation, easy to use | May lack advanced features | Best overall tool for most users |

| Bankrate APR Calculator | Accurate, trusted source | Requires personal information | Provides detailed breakdowns | May be overwhelming for new users | Ideal for detailed loan analysis |

| NerdWallet APR Calculator | 用户友好、免费 | Limited to credit cards and loans | Excellent for credit card comparisons | Limited to certain types of loans | Great for credit card APR comparisons |

| 贷款计算器 | 免费,无需注册 | 基本界面 | 快速、直接 | Basic features only | Good for quick APR estimates |

| Calculator.net APR Calculator | Free, unlimited access | Ad-supported | Easy to use, detailed output | 广告可能会分散注意力 | Useful for simple calculations |

| Credit Karma APR Calculator | 免费,无需注册 | 需要创建账户 | Provides insights into credit scores | Limited to users with Credit Karma accounts | Best for users with existing Credit Karma accounts |

| SmartAsset APR Calculator | Free, user-friendly | 有限的定制 | Comprehensive loan comparisons | Basic user interface | Good for general APR calculations |

| Zillow APR Calculator | Free, detailed output | Mortgage-focused | Great for mortgage APR calculations | Limited to mortgages | Excellent for home loan comparisons |

| US News APR Calculator | Free, reliable | Focuses on loans and credit cards | Accurate and reliable data | Limited to specific loan types | Useful for reliable APR data |

| MyBankTracker APR Calculator | Free, unlimited access | 基本功能 | Good for general APR estimates | Limited to basic functions | Ideal for straightforward calculations |

Future Prospects of APR Calculators

The future of APR calculators will likely involve more advanced features, such as integration with financial planning tools and artificial intelligence to provide personalized recommendations. Enhanced user interfaces and real-time updates will also become more prevalent, making it easier for consumers to make informed borrowing decisions.

常见问题

- How to calculate APR? APR is calculated by taking the total cost of borrowing, including interest and fees, and dividing it by the loan amount. This is then annualized to give a percentage rate.

- How is APR calculated? APR is calculated using the formula: APR = (Total Interest + Fees) / Loan Amount / Number of Years × 100. It reflects the true cost of borrowing.

- Are balance transfer APR calculated monthly? 是的,余额转账年利率通常按月计算,但年利率是按年计算的。

- 如何计算年度年利率? 年度年利率的计算方法是将月利率乘以一年中的期数,转换成年利率。

- 年利率在周末计算吗? 年利率根据贷款条款计算,不受周末或节假日影响。但是,在这些时间段仍可能产生利息。

结论

年利率计算器是了解真实借款成本的重要工具。它们可以帮助用户比较贷款报价、规划财务并做出明智的决定。这里列出的工具提供了一系列选项,以满足不同的需求,其中推荐的是 复利计算器 being a top choice for its comprehensive features and ease of use.tions needed to assess a property’s profitability, helping you make smarter investment decisions. Whether you’re a seasoned investor or just starting out, using a reliable calculator like the one from 复利计算器 可以指导您成功进行房地产投资。t 计算器这样,您就可以最大限度地利用退休储蓄,确保有一个安全的未来。