Plan Long-Term Savings

Secure Your Retirement

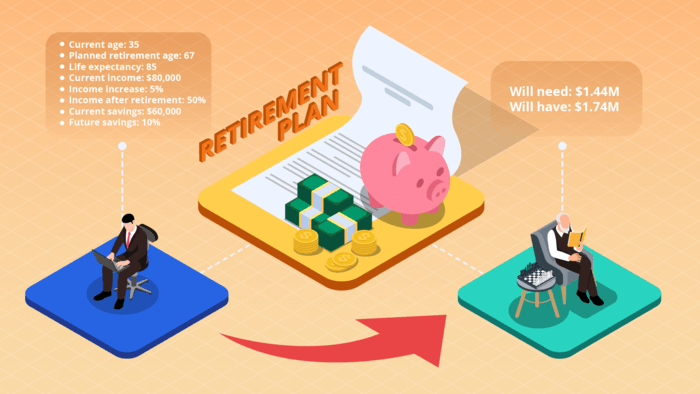

Estimate how much you need to save for retirement to ensure financial security and peace of mind.

Retirement Calculator

Retirement Calculator

Essential Financial Calculators For You

Discover the perfect financial calculator for your specific goals whether you’re planning investments, managing loans, or budgeting for the future!

Retirement Calculator: Your Ultimate Guide to Planning a Secure Future

Discover the importance of using a retirement calculator. Explore the best tools available, including free options with no sign-up required. Learn how to calculate your retirement savings and secure your future.

Table of Contents

What is a Retirement Calculator?

A retirement calculator is an essential tool that helps individuals estimate the amount of savings they will need to retire comfortably. These calculators consider various factors like annual income, retirement age, savings plans, and expected rate of return to provide an accurate projection of your financial future.

Why Use a Retirement Calculator?

Using a retirement calculator is crucial for anyone planning for the future. It helps you:

- Determine how much you need to save for retirement.

- Estimate the impact of inflation on your savings.

- Plan for social security benefits and tax-advantaged savings accounts.

- Make informed decisions about mutual funds, traditional IRAs, and other investment options.

Features and Characteristics of a Retirement Calculator

Retirement calculators offer various features to help you plan effectively:

- Savings Estimation: Calculate the amount needed to achieve your retirement goal.

- Income Projections: Estimate your retirement income based on current savings, contributions, and expected return.

- Inflation Adjustment: Factor in the inflation rate to understand how it will affect your savings.

- Social Security Calculation: Include social security benefits in your retirement plan.

- Retirement Age Determination: Estimate the optimal retirement age based on your savings and desired lifestyle.

How to Use a Retirement Calculator

Using a retirement calculator is straightforward:

- Input Your Data: Enter your current age, retirement age, annual income, savings, and expected rate of return.

- Adjust for Inflation: Include an estimated inflation rate to get a realistic projection.

- Consider Social Security: Add expected social security benefits to your calculations.

- Review and Adjust: Analyze the results and adjust your savings plan if necessary to meet your retirement goals.

Who Should Use a Retirement Calculator?

Retirement calculators are ideal for:

- Individuals Planning for Retirement: Anyone looking to understand their financial future should use a retirement calculator.

- Financial Advisors: Professionals helping clients plan their retirement can benefit from these tools.

- Investors: Those with savings plans or mutual funds can use calculators to estimate the growth of their investments.

10 Best Retirement Calculator Tools: Pros, Cons, Advantages, Challenges, and Recommendations

| Tool Name | Pros | Cons | Advantages | Challenges | Recommendations |

|---|---|---|---|---|---|

| Dave Ramsey Retirement Calculator | Easy to use, No sign-up required | Limited to basic calculations | Great for beginners | Not suitable for complex financial scenarios | Best for simple, quick estimates |

| FERS Retirement Calculator | Federal employees specific, Accurate projections | Limited to FERS participants | Detailed government retirement info | Only for FERS-covered employees | Ideal for government workers |

| Vanguard Retirement Savings Calculator | Comprehensive, Includes multiple accounts | Requires account creation | Detailed, personalized results | May be complex for beginners | Best for comprehensive planning |

| Bankrate Retirement Calculator | No sign-up required, Simple interface | Limited investment options | Great for general planning | Not detailed for specific investments | Ideal for general use |

| Fidelity Retirement Calculator | Integrated with Fidelity accounts, Detailed projections | Requires account sign-in | Tailored to Fidelity users | Limited outside of Fidelity | Best for Fidelity account holders |

| Charles Schwab Retirement Calculator | No sign-up, Customizable | Less detailed compared to others | Easy to use for Schwab clients | Focuses on Schwab products | Ideal for Schwab users |

| Retirement Calculator by SmartAsset | No sign-up, User-friendly | Advertisements, Limited customization | Accessible for all users | Ad interruptions | Best for quick, accessible estimates |

| Personal Capital Retirement Planner | Comprehensive, Free with sign-up | Requires linking accounts | Detailed financial planning | Potential privacy concerns | Ideal for tech-savvy users |

| T. Rowe Price Retirement Calculator | No sign-up, Simple interface | Limited advanced features | Great for quick estimates | Not detailed enough for complex scenarios | Best for basic planning |

| Jammable Retirement Calculator | Free, no sign-up, Unlimited calculations | Basic interface | Perfect for beginners and experts | Limited to retirement calculations | Recommended for anyone seeking a reliable tool |

Future Prospects of Retirement Calculators

As technology advances, retirement calculators will continue to evolve, offering more personalized and detailed projections. Integration with financial planning software, AI-driven recommendations, and real-time data updates will make these tools indispensable for retirement planning.

FAQ

- How long will retirement savings last calculator?

- Use tools like the Bankrate Retirement Calculator to estimate how long your savings will last based on various factors like retirement age and annual income.

- How much do I need to retire calculator?

- The Fidelity Retirement Calculator helps you determine how much you need to save for retirement, considering your current savings and expected expenses.

- When can I retire calculator?

- The Vanguard Retirement Calculator offers insights on the optimal retirement age based on your savings and desired lifestyle.

- How do I calculate my Texas teacher retirement?

- The FERS Retirement Calculator provides a tool specifically for federal employees, including Texas teachers, to calculate retirement benefits.

- How long will my retirement savings last calculator?

- Again, tools like the Bankrate Retirement Calculator can be used to project the longevity of your retirement savings.

- How much should I have saved for retirement?

- The Dave Ramsey Retirement Calculator helps you determine how much you should have saved based on your age and income.

- What is the best retirement savings calculator?

- The Personal Capital Retirement Planner is considered one of the best for comprehensive planning.

- How much do you need to retire calculator?

- The Charles Schwab Retirement Calculator offers insights on the amount needed for retirement based on various factors.

- What is the retirement age calculator?

- The T. Rowe Price Retirement Calculator helps you estimate the best age to retire.

- How does inflation affect retirement savings?

- Most retirement calculators, like the Jammable Retirement Calculator, include options to adjust for inflation to provide realistic savings estimates.

Conclusion

A retirement calculator is an indispensable tool for anyone serious about securing their financial future. By using the best tools available, like those mentioned above, you can ensure that you are on the right track to meet your retirement goals. The Jammable Retirement Calculator is highly recommended for its ease of use and comprehensive features.nd ensure a secure future.